Tesla regulatory credit sales have generated nearly $11 billion in pure profit over the past decade. This essentially subsidized the company’s growth while competitors paid to avoid government fines. However, recent legislative changes are dismantling this lucrative revenue stream. This comes just as Tesla faces its worst sales slump in company history. Moreover, Tesla regulatory credit sales represented the difference between profit and loss in recent quarters. This makes the policy shift potentially devastating for the EV pioneer’s financial future.

The irony is hard to miss. Elon Musk’s political activism helped create the very policies that now threaten one of his company’s most profitable business lines. Furthermore, this dramatic shift reveals how much Tesla’s success depended on a regulatory framework. Competitors were essentially forced to subsidize this framework.

How Tesla Regulatory Credit Sales Built an $11 Billion Empire

Tesla Credit Sales: The Regulatory Money Machine

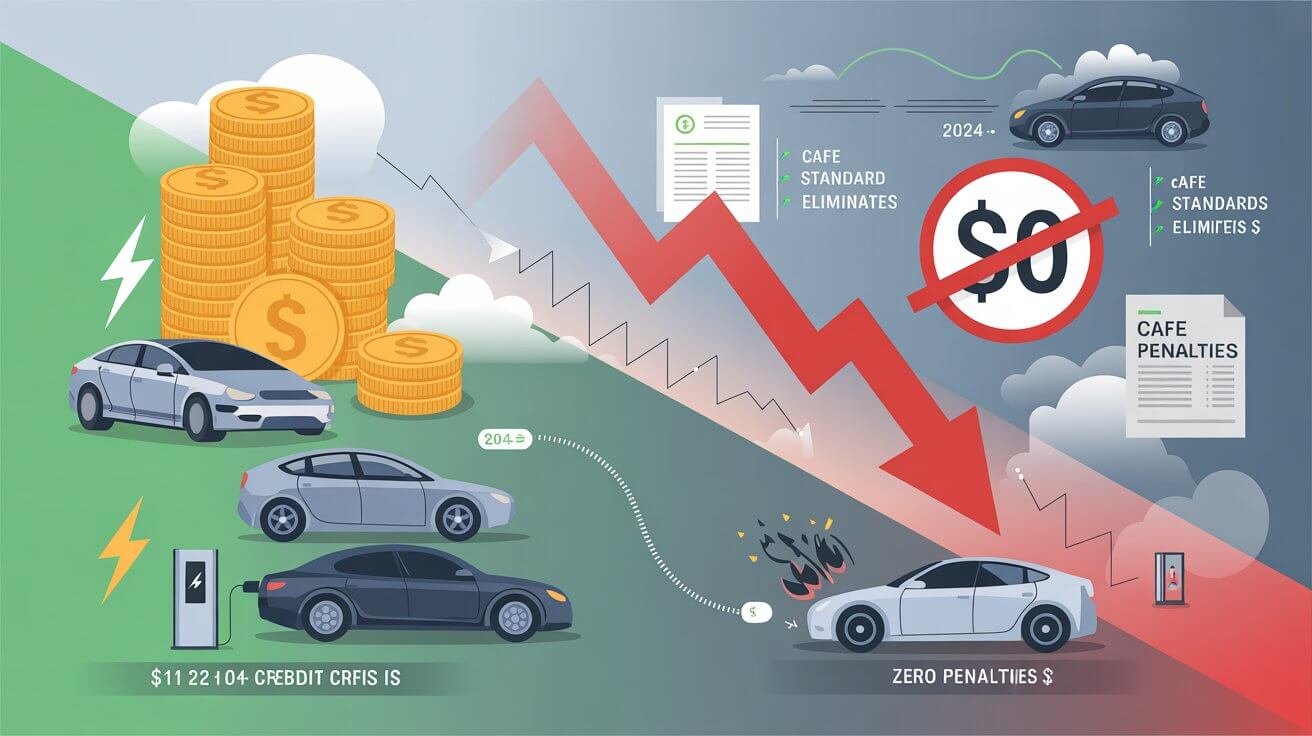

Tesla regulatory credit sales work through a surprisingly simple mechanism that has generated massive profits. Government regulations require automakers to meet increasingly strict fuel economy and emissions standards. Companies that exceed these standards earn credits they can sell to manufacturers struggling to comply. Tesla, with its all-electric lineup, falls into this category.

Traditional automakers like Ford, GM, and Stellantis have paid billions to Tesla. This helps them avoid even steeper government fines. Furthermore, these transactions represent nearly pure profit for Tesla. The credits cost virtually nothing to produce—they’re essentially a byproduct of making electric vehicles.

The Corporate Average Fuel Economy (CAFE) standards have been particularly lucrative. Penalties reach $17 per vehicle for each tenth of a mile per gallon that manufacturers fall short. Additionally, European Union emissions rules have created another massive market. Tesla pools with traditional automakers to help them avoid fines in this system.

The Numbers Behind Tesla Regulatory Credit Sales Success

The scale of Tesla regulatory credit sales is staggering when you examine the data. In the first quarter of 2025 alone, Tesla earned $595 million from credit sales. Meanwhile, the company reported only $420 million in net income. This means Tesla would have lost money without these credits. Moreover, over the past five quarters through Q1 2025, Tesla has generated $3.36 billion from regulatory credits.

Recent years show the growing importance of this revenue stream. Tesla earned $2.76 billion from regulatory credits in fiscal 2024. The company made $1.79 billion in 2023, and $1.78 billion in 2022. Additionally, Tesla has secured long-term contracts worth $4.7 billion in future credit sales. This includes $683 million expected in the next 12 months.

From a per-vehicle perspective, Tesla has averaged around $1,700 in regulatory credit revenue per car sold over the past five years. However, this figure has fluctuated significantly. It reached $1,544 per vehicle in 2024 after dropping to $990 in 2023.

Political Changes Threaten Tesla Credit Sales Revenue

Trump’s “Big Beautiful Bill” Dismantles the System

The regulatory landscape supporting Tesla regulatory credit sales has fundamentally changed. This shift came with the passage of Trump’s budget legislation. The “One Big Beautiful Bill Act” enacted on July 4, 2025 effectively eliminated civil penalties for CAFE noncompliance. The legislation accomplished this by setting fines to $0.

This policy change removes the primary incentive for traditional automakers to purchase Tesla’s credits. Furthermore, companies like GM and Ford no longer face penalties for missing fuel economy targets. As a result, they no longer need to buy credits to avoid government fines. The result is the collapse of a market that has generated billions for Tesla.

Additionally, the legislation eliminates EV tax credits after September 2025. It also revokes EPA waivers that allowed states like California to enforce stricter emissions standards. Moreover, these changes represent a comprehensive rollback of policies that have supported EV adoption. These same policies created demand for Tesla’s credits.

The Musk Paradox: Political Victory, Business Loss

Elon Musk’s political activism has created an unprecedented situation. His support for Trump administration policies directly undermines his own company’s profitability. As Dan Becker from the Center for Biological Diversity noted, “A key element of Tesla’s profitability has been its ability to generate credits.” He continued, “By taking away these credits, they’re taking away a key element of Tesla’s profitability.”

The timing couldn’t be worse for Tesla. Moreover, the company has reported record sales declines in recent quarters, partly attributed to consumer backlash against Musk’s political activities. Furthermore, losing the regulatory credit revenue stream while facing sales challenges creates a perfect storm of financial pressure.

Tesla regulatory credit sales have essentially subsidized the company’s aggressive pricing strategies and massive capital investments in manufacturing. However, without this financial cushion, Tesla will need to rely entirely on vehicle sales and emerging businesses like energy storage and autonomous driving.

How Regulatory Credit Sales End Affects Tesla Competitors

Legacy Automakers Get a Free Pass

The elimination of CAFE penalties fundamentally changes competitive dynamics in the auto industry. Companies like GM and Stellantis, which have paid over $550 million in fines since 2022, suddenly face no consequences for continuing to focus on profitable trucks and SUVs rather than electric vehicles.

Ford, which has never been fined under CAFE standards due to its hybrid offerings, still benefits from reduced pressure to accelerate EV development. Moreover, traditional automakers can now redirect resources from compliance efforts to their most profitable product lines without regulatory consequences.

The policy change also affects international markets where Tesla regulatory credit sales have been growing. European emissions rules still exist, but Tesla’s declining sales overseas make it harder for the company to generate enough credits to meet its contractual obligations to companies like Stellantis.

The Broader EV Market Impact

Beyond Tesla, the elimination of regulatory incentives could slow overall EV adoption by removing penalties that encouraged automaker investment in electric vehicles. Furthermore, without the threat of fines, traditional manufacturers may reduce EV development spending and focus on more profitable internal combustion engine vehicles.

This shift potentially benefits Chinese automakers like BYD, which have achieved cost leadership in EV production without relying on regulatory credits. Moreover, as the U.S. market becomes less favorable to EVs through policy changes, international competitors may find opportunities to gain market share in other regions.

The ripple effects extend to charging infrastructure, battery suppliers, and the entire EV ecosystem that has developed around the assumption of continued regulatory support for electrification.

Practical Implications for Investors and Consumers

Investment Considerations

Tesla regulatory credit sales have masked underlying profitability challenges that investors must now confront directly. William Blair analysts project credit revenue will fall 75% in 2026 and disappear entirely by 2027, creating a direct hit to Tesla’s bottom line.

For Tesla shareholders, this means the company must achieve profitability growth through vehicle sales, energy storage, or autonomous driving services rather than regulatory arbitrage. Moreover, Tesla’s stock valuation may need to adjust to reflect the loss of this high-margin revenue stream.

Investors should also consider how this affects Tesla’s competitive positioning. Furthermore, without the financial advantage of credit sales, Tesla may struggle to maintain its aggressive pricing while investing in new technologies and manufacturing capacity.

Consumer Market Effects

The policy changes create mixed effects for car buyers. Traditional automakers may increase production of popular trucks and SUVs without penalty, potentially keeping prices stable for these vehicles. However, the elimination of EV tax credits after September 2025 makes electric vehicles more expensive for consumers.

Tesla may need to raise prices to maintain profitability without regulatory credit revenue, potentially making its vehicles less competitive. Moreover, reduced EV incentives across the industry could slow adoption rates and limit charging infrastructure development.

For environmentally conscious consumers, the policy changes represent a significant setback in the transition to cleaner transportation. Furthermore, without regulatory pressure, automakers have less incentive to develop more efficient and cleaner vehicles.

Future Without Tesla Regulatory Credit Sales: What Comes Next

Tesla’s Adaptation Strategy

Tesla must rapidly diversify its revenue streams as regulatory credit sales disappear. The company’s energy storage business has shown promise, with growing demand for utility-scale battery installations and residential Powerwall systems. Additionally, Tesla’s Supercharger network monetization and autonomous driving technology could provide new income sources.

Manufacturing efficiency improvements become crucial without the regulatory credit buffer. Moreover, Tesla may need to accelerate its lower-cost vehicle development to maintain market share as price competition intensifies. The company has hinted at more affordable models, but timing becomes critical as financial pressure mounts.

International expansion also takes on greater importance as Tesla seeks markets where regulatory frameworks still support EV adoption. Furthermore, countries with strong climate commitments may maintain incentive structures that benefit Tesla’s business model.

Industry-Wide Transformation

The end of Tesla regulatory credit sales signals a broader transformation in the automotive industry. Traditional automakers may slow their EV transitions, focusing instead on profitable hybrid technologies that improve fuel efficiency without requiring full electrification.

This shift could create opportunities for new entrants, particularly from China, where government support for EVs remains strong. Moreover, companies that have achieved genuine cost leadership in EV production may gain competitive advantages as regulatory subsidies disappear.

The charging infrastructure industry faces uncertainty as reduced EV adoption forecasts may slow investment. However, companies already committed to electrification may find opportunities as competitors retreat from the market.

Long-term Climate and Energy Implications

The elimination of regulatory incentives for cleaner vehicles represents a significant policy reversal with long-term environmental consequences. Without penalties for inefficient vehicles, automakers have less incentive to improve fuel economy or reduce emissions.

This policy change could extend America’s dependence on petroleum while other countries accelerate their transitions to electric transportation. Furthermore, the loss of domestic EV momentum may cede technological leadership to international competitors, particularly Chinese manufacturers.

Energy independence goals may also suffer as reduced domestic EV adoption means continued reliance on imported petroleum rather than domestically produced electricity for transportation needs.

The collapse of Tesla regulatory credit sales marks the end of an era that has defined the electric vehicle industry for over a decade. This $11 billion revenue stream has essentially subsidized Tesla’s growth while traditional automakers paid to continue producing less efficient vehicles.

The policy changes reveal both the artificial nature of Tesla’s regulatory credit advantages and the challenges facing the EV industry without government support. Moreover, Tesla must now prove it can compete on the merits of its products rather than regulatory arbitrage.

For the broader auto industry, the elimination of CAFE penalties removes a key driver of electrification, potentially slowing the transition to cleaner vehicles. Furthermore, this shift may benefit traditional automakers in the short term while creating long-term competitive risks if international markets continue supporting EVs.

The next few years will determine whether Tesla can successfully transition from a regulatory credit-dependent business model to sustainable profitability through product sales and new technologies. Additionally, the industry will test whether market forces alone can drive the automotive transformation that regulatory pressure has supported for the past decade.

Ultimately, the end of Tesla regulatory credit sales represents more than just a financial challenge for one company—it’s a fundamental test of whether electric vehicles can succeed without government support in an increasingly competitive global market.